THE FIRST ICO BASED ON TOKEN BUY-BACK SCHEME — YORITEX

Yoritex with the developed and unique SimcoePay™ makes cryptocurrency exchange to be done at the best rate, and it allows for modern comfortable alternative banking solutions both for EU residents and non-residents, for users of cryptocurrencies and adherents of the traditional monetary system.

For centuries, technological progress has been an important force in the transformation of finance. Innovation in the financial sector has a long history ranging from the development of double-entry book keeping, to the establishment of modern central banks and payments systems, and the more recent introduction of complex asset markets and retail financial products.

Change has accelerated in the new millennium. New payment tools have emerged (such as digital wallets), and new service providers have entered the market for financial services (including internet, retail and telecom firms). Recent years have witnessed a rise in automation, specialization, and decentralization, while financial firms have found increasingly efficient and sophisticated ways of leveraging vast quantities of consumer and firm data.

Mobile access and the internet have been transformational, allowing the gains from technological progress to be shared directly with billions of individual consumers whose mobile devices are now portals for accessing a full range of financial services, and can be extended by third parties via Application Programming Interfaces (APIs). This massive decentralization is opening the door to direct person-to-person transactions (P2P), and to the direct funding of firms (crowd-funding). It has profound implications also for financial inclusion by permitting “unbanked” consumers in low income countries to access financial services for the first time.

These innovations feed off each other, driving rapid change. FinTech innovations are characteristically overlapping and mutually-reinforcing.

SimcoePay™ Online Banking

SimcoePay™ Online Banking combines feature of modern banking, IoT, Big Data and Blockchain-based technologies while also meeting security and UX requirements.

With a SimcoePay™ SIM Current Account you can make and receive payments instantly. Having an account allows you to centralise incoming and outgoing payments, which makes reconciliation easier. You spend less time on manual processes and the cost of operating the bank account itself is reduced.

SimcoePay™ Online Banking is a bank without the hassle. Generally speaking-your business can get an account set up in a few simple clicks. You don’t have to clear time in your schedule to visit the bank office, no paperwork to sign.

With SimcoePay™ Online Banking you get a safe infrastructure for secure transactions, regulated in the same way a normal bank is. The same EU rules and regulations apply, so your funds are safe.

SimcoePay™ Online Banking works with multiple banking networks simultaneously which means you multiple banks working for you in one.

Looking at the market from this new perspective, SimcoePay™ Online Banking recognizes the need for a simpler way to do business in Europe. If you're a global exporter that doesn't yet have the volume to set up subsidiaries to meet the requirements for traditional bank account opening, you must rely on wire transfers from your importer. That means delays and a steep fee of 3% to 6% per transaction. With SimcoePay™ Online Banking IBAN account you can receive payments in the EU, without the hassle or the costs.

SimcoePay™ Online Banking offers you a SIM Current Account that provides the exact service you need from a bank account. No costly unnecessary services, complex applications or complicated compliance processes.

SimcoePay™ Online Banking is the perfect solution for your international business.

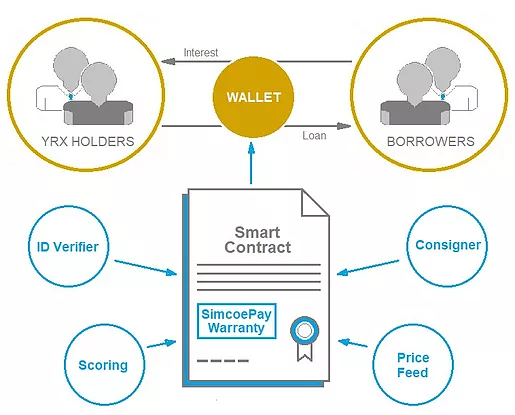

The SimcoePay™ P2P lending platform is an intermediary platform connecting borrowers with investors by offering safe and transparent investment opportunities.

Earn up to 24% per annum with a diversified portfolio of consumer loans or borrow money when you need it.

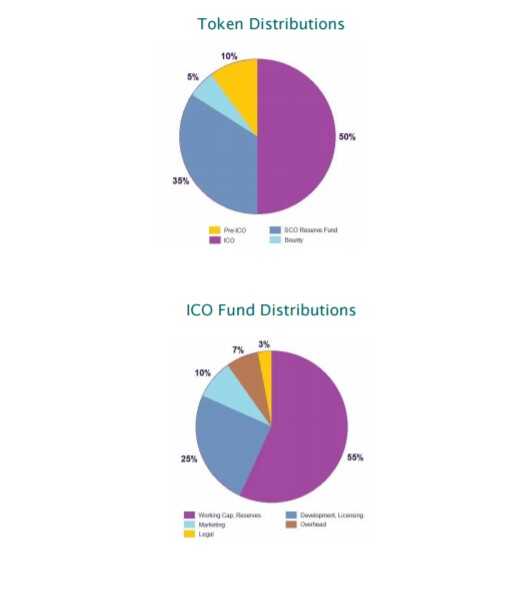

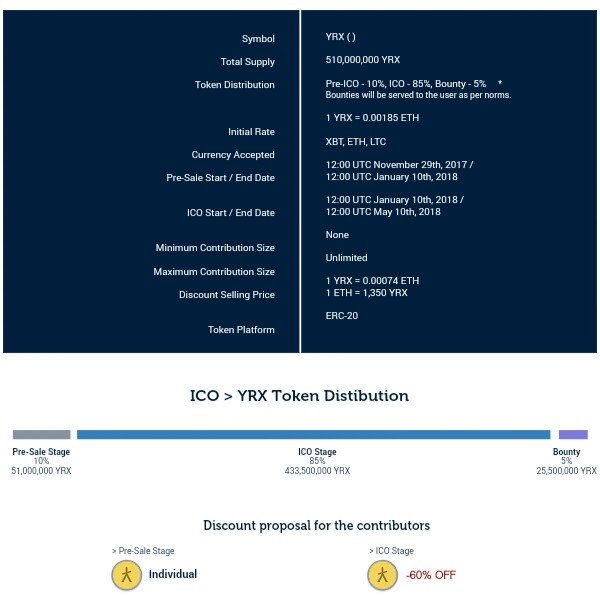

YRX Tokensale Breakdown

ICO Details

For more information, please visit:

Website: https://www.yoritex.com/

Facebook: https://www.facebook.com/Yoritex/

Twitter: https://twitter.com/Yoritex_Inc

Bounty: https://bitcointalk.org/index.php? topic = 2470823.0

Author: selapesek

My BitcoinTalk Profile: https://bitcointalk.org/index.php?action=profile;u=1159963

Komentar

Posting Komentar